- Source: gstthehelplineindia.com

“A tax loophole is something that benefits the other guy. If it benefits you, it is tax reform.”

-Russell B. Long

Indian government levies two types of taxes to generate revenue, namely Direct tax and Indirect tax. This revenue so collected is then utilized for the various fiscal expenditures necessary for the smooth functioning and development of the economy.

The direct tax is borne by the individuals, depending upon their income from various sources such as salary, commission or rent from property etc. On the other hand, indirect tax is levied on goods and services procured by individuals and households. Direct tax is levied on income of those individuals whose income exceed beyond a prescribed limit, whereas, indirect tax is equal for the poor and the rich depending upon the various goods and services they buy.

In India, until July 1, 2017, there existed a multitude of indirect taxes that were levied by the center as well as the respective state governments. Now, most of them have been subsumed within a single indirect tax called the Goods and Services Tax (GST).

GST is a unified destination based tax levied on supply of goods and services throughout India and the purpose of implementing it, is to simplify the indirect tax structure of the country.

The idea of adopting a single indirect tax for the entire country was first envisaged by Atal Bihari Vajpayee led government in the year 2000. Gradual progress was made during the Congress regime for implementation of GST. However,the process took the pace after Narendra Modi led BJP government came into power in May 2014 and fresh efforts were initiated to ensure smooth implementation of GST. In 2017, four bills related to GST were passed and July 1, 2017 was declared as the implementation date for historical GST bill.

Now, it has been a year since the GST was introduced. A lot has been criticised, a lot has been implemented and a lot is still to be done. Through this article, we will acknowledge various aspects including the developments, implementation challenges, its benefits as well as the areas that require attention.

GST in India and its comparison with the world

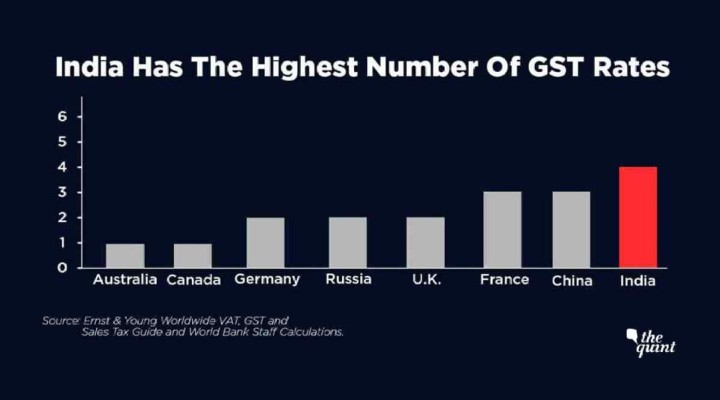

On global level, GST was first brought in by France while trying to evade the hectic taxation system and since then, 160 countries have adopted GST including India. India’s model shares some similarities with the Canadian Model of Dual GST yet, it has its own unique propositions which sets it apart from the other models as adopted by various other countries. For instance, India has multiple slab rates for different goods and services with a maximum rate of 28%, which is way higher in comparison to other countries.

- Source: thequint.com

The threshold exemption limit in India is 20 Lakhs (10 lakhs for North Eastern states) but it is mostly higher in different countries like Canada, UK, etc. The reverse charge mechanism in India applies to goods as well as services but in other countries it’s mostly applicable to only imported services or supply of services.

GST- Journey so far

Initially, GST faced a lot of criticism due to implementation issues however, administrative flexibility and political will in terms of working on feedback mechanism as well as in addressing the issues makes it quite evident that pending issues will be resolved at the earliest. The effect of the same had been experienced in the previous fiscal year.

- No rise in Inflation – It was expected that there will be an initial rise in inflation in the Indian economy but it didn’t happen because of the multiple slab structure. The rise in the consumer index was because of other factors like high food and fuel prices. The other factor was the anti-profiteering society which ensured that the businesses didn’t abuse the transition.

- No more long queues on state borders – The overall efficiency of transportation has improved because of the dismantling of state barriers. The barriers were a cause of restricted movement of goods throughout the country leading to delays and increased costs of logistics, eventually leading to higher cost for consumers.

- Formalization of economy – It was expected that GST would encourage formalization of the economy. The digital processes and incentive of input crediting and invoice matching will help in reducing tax evasion. As a result, more and more businesses have started signing up for GST, which is a very good sign for the overall well being of the economy.

- Less complications – Around 17 taxes and multiple cesses have been subsumed into a single and unified tax. Central taxes such as excise duty and service tax while state taxes such as Octroi, VAT and Purchase tax, all have been rolled down into one. This helps in a free flow of tax credits which helps in boosting company’s financials which in turn, helps the customers with reduced prices.

GST : Recent Developments

The government has been trying to minimise difficulties that the businesses face by issuing clarifications and activating dormant provisions. For instance , where they clarified that refund claims should be filed and processed manually on account of zero-rated supplies and also where they clarified that the shipping bill acts as an application for IGST refund. Apart from these there are other developments such as development of the Android App for the generation of E-way Bill and other technical clarifications.

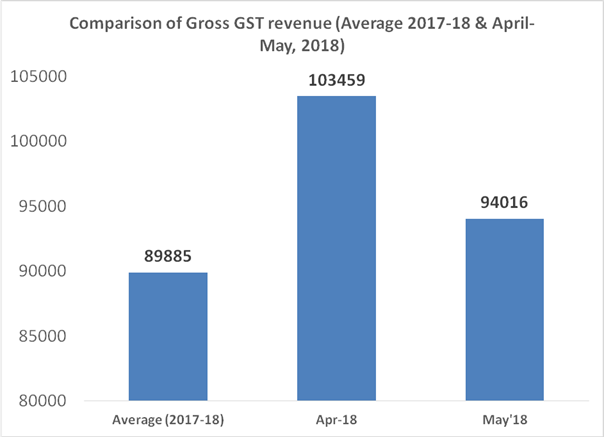

- Source: pib.nic.in

The Total Gross GST collection for the month of May 2018 was Rs 94,016 Crores which is higher than the monthly average collection of the previous financial year (Rs 89,885 crore). The total number of GSTR 3B returns filed from April to May 2018 was 62.47 lakh. There has been a 50% increase in the number of indirect taxpayers and also in the voluntary registrations especially by small businesses that buy from large-scale businesses and are looking to avail input credits.

GST – Way forward

As expected, the speculations were far from realization. GST had its own implications which needed a prior simulation. The very purpose of GST was to eliminate the complexities within the structure, however, few issues still require attention:

- Compliance – The IT glitches take more than the anticipated time to be resolved. The return form is a cumbersome process for the businesses and as of now, a new return form is being crafted to make it easier.

- Cumbersome registration – Multiple registrations might mean multiple audits which the businesses are fearing as it might make their life difficult in the coming future.

- Introduction of new cesses – The whole purpose of GST was to reduce the multiplicity of taxes and cesses but new levy introduced on luxury items has led to complexity within the system.

- Refund mechanism for exporters – The data matching law and procedures to govern smaller entities have augmented problems for exporters because of the rise in working capital requirements.

Thus to match up with its expectations, GST has a long way to go and has a lot of challenges that need to be conquered. These include bringing products like alcohol, petroleum products, and immobile properties under the scope of GST when planning a new tax regime.

Conclusion

The only expectation is that the government continues to work in a flexible manner in resolving the existing as well as the upcoming problems. In a nutshell, it can be said that despite initial complications in the implementation, there is a favorable sentiment for GST in the long run and it has the capability to take Indian growth story forward.

References

- https://economictimes.indiatimes.com/news/economy/policy/one-year-of-gst-the-successes-failures-and-whats-next-on-the-agenda/articleshow/64787124.cms

- http://www.mondaq.com/india/x/664160/sales+taxes+VAT+GST/Recent+developments+under+GST+and+other+indirect+taxes

- https://cleartax.in/s/gst-india-and-other-countries-comparison

- https://www.thequint.com/news/business/india-gst-most-complex-28-percent-slab-second-highest-rate-in-world-world-bank