“The unrest is longer and more violent than I had expected. As long as we keep having such incidents every week, no investors will buy assets in Hong Kong”

-Steven Leung, Executive Director at Uob Kay Hian Ltd

Hong Kong has been in the news in recent days, for all the wrong reasons. Be its fervour in the airport, demonstration on streets, prolonged business shutdowns or stocks spiralling downwards like never before, one thing is for sure- the people in Hong Kong are not happy.

Why did this happen?

After long-standing British colonization (or so-called leasing) until 1997, Hong Kong was handed over to China under the concept of ‘One country, two systems’. This endowed the state with political and legal autonomy. Just as Kashmir was given a special status to be with India, Hong Kong was graced with a multitude of rights til 2047 (50 years from 1997), which even the people in the mainland China did not merit. This liberty that Hong Kong had was at times exploited by the Chinese government. The city was peaceful until recently when the Chinese government made some amendments to the Fugitive Offenders and Mutual Legal Assistance in Criminal Matters Legislation Bill (Amendment Bill) which enables any criminal suspect to be extradited to mainland China for trial. Why does the new amendment bother the citizens of Hong Kong? This bill also implies that thousands of Hong Kongers who have angered mainland China with a supposed crime could be at the risk of being extradited for trials in mainland China. This causes trepidation among people that the bill might allow China to target anyone in Hong Kong that it wants retribution from. Country’s Chief Executive Carrie Lam offered an apology for mishandling the extradition bill in person but did not meet the protesters’ demands of withdrawing the bill completely or resigning. Students unions, representing some protesters, issued four demands: total withdrawal of the extradition bill; retraction of all references to the 12 June protest being a riot; release all arrested protesters; and accountability of police officers who used excessive force.

This has brought the Hong Kongers (as they like to call themselves) to the streets. Roughly 1 million people of the semi-autonomous state demonstrated a protest against the amendments to the Extradition Law. The peaceful protest- one of the biggest in the state’s history turned violent the next day with several clashes with the police.

The Economy in Jeopardy:

After the protesters brought Hong Kong’s airport to a standstill on Monday, investors and business leaders are taken aback by the ramifications of the 10-week tensions that do not have signs of letting-up in the near future. Both short and long-term implications are visible.

In the short-term, Hong Kong faces a potential trepidation of a recession. This comes as an effect of the protests in combination with the US-China trade war, which has amplified the effects of a slowdown. The state is facing irreparable damage, not just in terms of reputation but also in terms of the investments it attracts.

In the long-term, the status of Hong Kong as a fundamental business centre is at stake.

Gross Domestic Product:

- GDP growth which was initially forecasted to be 2.5% has now been reduced and stands at 0% in 2019.

- State’s GDP fell by 0.3% in the last quarter whereas property transactions in the state fell by 35% during the same period.

Tourism:

- Almost 78% of the tourists come to Hong Kong from mainland China. Due to the developed tensions between the states, accompanied by trade-war that reduces the purchasing power of mainland Chinese, the number of tourists is expected to go rapidly down the gutter, thus reducing the revenue of the state from tourism activities.

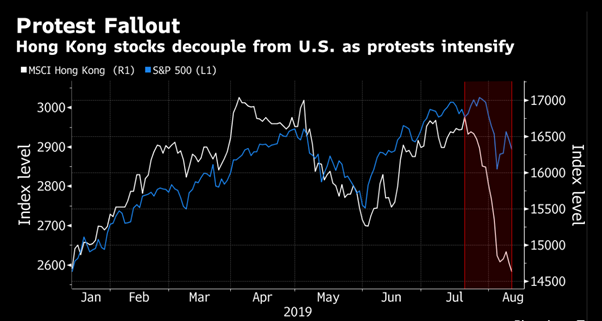

Stock Market:

- The Stock Exchange of Hong Kong, Asia’s third-largest stock exchange in terms of market capitalization, has lost nearly $500 billion in value since the protests kicked into high gear since June. The benchmark indexes were at a 7-month low when the clashes between mob and police increased.

Businesses:

- Retail sales are expected to fall by more than 5% from the previous year.

- As a matter of fact, China and the US are the top export destinations of Hong Kong. Due to the already existing trade tensions between the 2 biggest economies of the world, Hong Kong’s condition is exacerbated.

- Protests happening during weekdays have forced a lot of businesses to shut down temporarily. This could mean a lot of implications.

- The airport which handled 4,27,725 flights last year was the busiest in terms of international passenger traffic. For obvious reasons, this number is drastically reduced.

The economic difference between Mainland China and Hong Kong

Hong Kong is an international financial hub, business centre, shopping paradise, and tourist destination. Hong Kong has better per capita income, better GDP in terms of the size of the country. 90% of the contribution to Hong Kong is from services whereas mainland China focuses more on manufacturing. More importantly, the economy of Hong Kong is characterized by low tax rates, free trade, and less government interference while mainland Chinese has a more conservative and restrictive economy.

Is there light at the end of the tunnel?

As pointed by Point Bridge Capital Founder and CEO Hal Lambert, people are trying to pull their money out of the country, in addition to pulling themselves out. From an investor’s perspective, who will be ready to put their money into a state which is at the brink of recession, especially if it is corporate from outside the state? They will start looking for substitutes like Singapore or Taiwan(which is considered to be a haven for investors at this point). In the due course, the chief executive of the state promises to for a potential reconciliation of the situation in an attempt to restore peace in the state filled with fervour. Protests can be nerved down by withdrawal of the bill, considering to release arrested protestors, China’s non-intervention and holding back unfavourable comments regarding the protest. Nevertheless, in the past, Hong Kong was illustrious of its resilience when it comes to revamping its economy whenever there has been a fear of crisis. The biggest question as to whether the same resilience will be exhibited by the state this time too is pondered over by various stakeholders.