Introduction

With the launch of the Production-Linked Incentive (PLI) programs in the fiscal year 2021–2022, India set out on a bold new path intended to stimulate exports and local production. Notable progress has been made in a comparatively short amount of time; as of November 2023, investments have surpassed Rs 95,000 crore, which is more than 48% of the initial budget of Rs 1.97 lakh crore. This article examines the major accomplishments and industry-specific success stories, examining the opportunities and difficulties that India’s manufacturing sector may face in the future.

Strong Applications and Growth

The fact that 746 applications from 14 important industries—including electronics, telephony, pharmaceuticals, white goods, and textiles—were approved shows how popular the PLI schemes are. With PLI units currently operating in over 150 districts across 24 states, the plan has a huge geographic reach and the potential to create a sizable number of jobs.

Even though PLI schemes are still in their early phases, they have already had a profound impact on the industrial industry. In addition to creating more than 6.4 lakh direct and indirect jobs, the schemes have contributed more than Rs 7.80 lakh crore in output and sales. This initial achievement highlights the PLI programs’ transformative potential for India’s manufacturing industry.

Sector-Specific Success Stories:

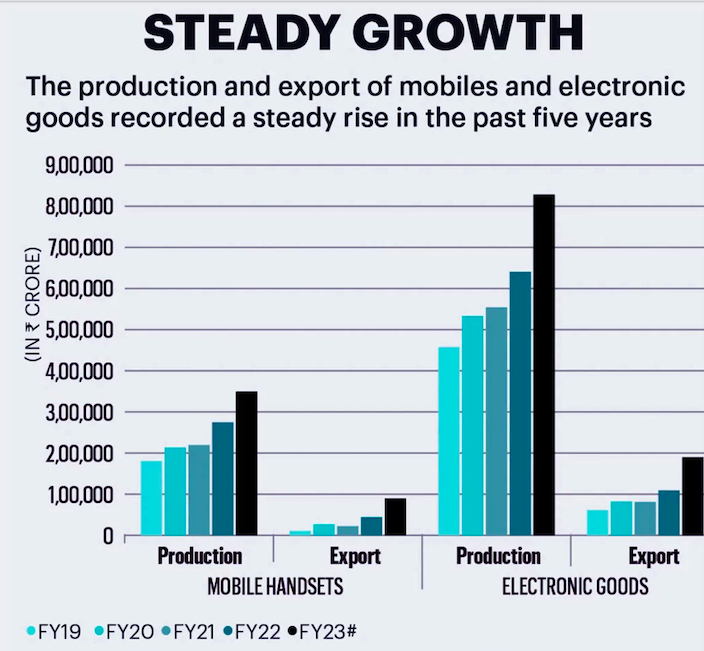

Electronics– In the electronics sector, the PLI scheme has catalysed a 20% increase in value addition within three years, particularly in mobile manufacturing. The success story unfolds as smartphone production now constitutes a substantial USD 44 billion out of the total USD 101 billion worth of electronics produced in India during the fiscal year 2022-23, including an impressive USD 11.1 billion in exports.

Source: Ministry of Electronics and Information Technology, India cellular and Electronics Association

Telecom– The PLI program has resulted in a noteworthy 60% decrease in imports, causing a paradigm shift in the telecom industry. A significant step towards self-reliance and indigenous proficiency, this decrease confirms India’s capabilities in critical sectors like antennas, Gigabit Passive Optical Network (GPON), and Customer Premises Equipment (CPE).

Pharma– The PLI scheme has had a major positive impact on the pharmaceutical industry, which is the backbone of the Indian economy. India is already producing special intermediate materials and bulk medications, including the vital Penicillin-G, locally after seeing significant drops in the import of raw materials. This is an important step in achieving self-sufficiency, decreasing reliance on outside resources, and strengthening India’s pharmaceutical independence.

White Goods (LED and AC Light Components)– 64 companies were chosen under the PLI scheme, indicating a spike in interest in this industry. Of them, thirty-four are investing Rs 5,429 crore in air conditioner components, and the remaining thirty are investing Rs 1,337 crore in the production of LED components. It is anticipated that just this phase will bring in an extra Rs 6,766 crore in investments and produce 48,000 direct jobs. The involvement of thirteen foreign enterprises underscores the PLI scheme’s worldwide appeal.

The Path Ahead

The PLI scheme’s early success indicates that it has the potential to revolutionize India’s manufacturing industry. However, consistent work and calculated changes are necessary to maximize its impact.

Ensuring Timely Disbursal of Incentives– Timely disbursal of incentives is paramount for providing crucial financial support to manufacturers and maintaining investor confidence. Delays in incentive payments could potentially hinder project timelines and dampen enthusiasm among potential investors.

Streamlining Application and Approval Processes– Reducing the administrative burden associated with the application and approval processes will encourage more businesses to take part in the PLI program. Simplifying processes can help projects be implemented more quickly, which will increase the schemes’ overall success.

Technology Transfer and Skill Development– Maintaining long-term growth requires both transferring technology and developing a skilled labour force. The PLI plan ought to prioritize measures that augment the competencies of the indigenous labour force, guaranteeing that the advantages surpass short-term financial rewards.

Extending the Scheme’s Purpose– Investing in PLI in novel, highly promising fields like eco-friendly technologies and electric cars could bolster India’s economy. The PLI scheme may continue to be a dynamic and significant engine of economic growth by making adjustments in response to changing market trends and technological breakthroughs.

Challenges and Opportunities

While celebrating the achievements of the PLI schemes, it is crucial to acknowledge the challenges that lie ahead. Timely implementation, avoiding bureaucratic bottlenecks, and ensuring that the benefits reach all corners of the country are critical considerations.

Conclusion

In conclusion, the initial success of India’s PLI schemes is not only promising but also indicative of their potential to propel the country’s manufacturing prowess onto the global stage. By addressing existing challenges and strategically expanding the scheme’s scope, India can foster a self-reliant and export-driven economy. The PLI schemes have already made significant strides, and with continued dedication and refinement, they can play a pivotal role in shaping the future of India’s industrial landscape. As the nation continues on this transformative journey, the PLI schemes stand as a beacon of hope for a thriving and globally competitive manufacturing sector.