When the corporate tax was cut, stock markets rejoiced. Share prices rose and investors believed that an overnight solution had come. The Government of India, when going for tax cuts which cost the exchequer a whopping INR 1,45,000 crore, had thought that ‘We don’t know how to effectively make public investments to boost the economy, so why not let the corporates take care of it’. Was the government right in its decision? It’s a yes and a no, as we will soon see.

Medium Term Benefits

Will the tax cut benefit the corporates? Of course, but will corporates be willing to invest these benefits in the form of scaling up production? This is highly unlikely given the fact that corporates are underutilizing their existing capacity due to lack of demand. Let’s say you produce 100 pairs of shoes and only 70 pairs are getting sold. Even if the government gives you tax incentives why would you expand your production if you can meet your demand with existing production? What the corporates are likely going to do is either pay off their existing debts or increase the dividend paid out to the shareholders. Another wave of discounts in the price cannot be expected as well, because companies have already tried giving out price cuts but the market didn’t respond in kind.

Should we expect employee wages to increase or retrenchment to decrease? This again is unlikely because if capacity remains unutilized then retrenchment will continue. It started with the dismissal of contract workers and now even the permanent employees are offered VRS for early retirement.

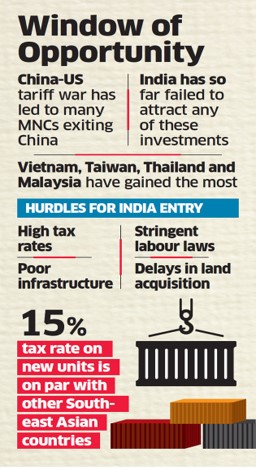

So, where did the government get it right? The decision to cut tax on new manufacturing companies to 15% came at the right time. When the US and China are engaged in slapping tariffs on each other, companies wary of the development would be looking for new avenues to invest. For them, India might appear as a more lucrative option now. In China, out of its entire exports, 40% comes from foreign companies that have set up their manufacturing plants in China. This is a number that India Inc eyes on. Moreover, the lower-wage advantage enjoyed by China is also no longer in their basket of offerings to companies. This is ideal for India, which has labour on offer at a lower cost as well as a favorable relationship with the US and now a lower tax rate.

Role of the Unorganized Sector

With the tax sops announced by the government, it has failed to address the elephant in the room – lack of consumer demand. Indian economy is more dependent on consumer consumption than on exports, which is also one of the reasons we were impacted to a lesser extent when the financial crisis of 2008 happened. Consumer demand comes when the consumer has enough income to spend. With around 90 percent of the workers in India working in the unorganized sector (farmers, agricultural laborers, roadside vendors, Dhaba owners, housekeepers, etc), tax cuts announced for corporates won’t change the wages earned in this sector, consumption at the grass-root level will remain low.

The government has tried to woo in manufacturers exiting China, who will contribute to the overall exports of the country while ignoring the consumer consumption within its borders. Will such a strategy revive growth? Maybe it will, but at what cost?

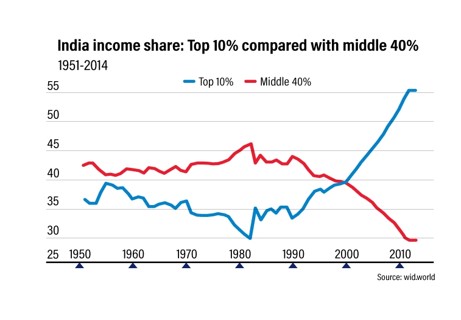

Increasing Wealth Gap

According to the Global Wealth Report published by Credit Suisse in the year 2018, the richest 10% Indians own 56% of the nation’s wealth, while the bottom 60% owns less than 5%. With the tax cut, this gap could widen. Let us assume that demand picks up over time, now the companies can start investing since they can make higher profits. But most big scale businesses in India depend on capital-intensive production modes instead of labor-intensive production. This means companies would invest in newer technologies like automation, IoT, cloud, etc for increasing their capacity. Thus, there will neither be an increase in jobs for laborers nor an increase in their incomes.

Consumers are becoming reluctant to consume because of being trapped in a vicious cycle. The disruption in the unorganized sector started with the introduction of demonetization and got worse due to the inefficient implementation of GST. It saw people working in urban unorganized sector losing jobs and moving to their rural natives. In the rural sector the jobs are scarce and volatile, whatever jobs the government gives through the National Rural Employment Guarantee Scheme has been fraught with irregularities in payment. This leads to a decrease in overall demand which ultimately results in further job losses in the unorganized sector.

Necessary Structural Changes

We need demand to pick up. But the $5 trillion question is, how? Economic output is a function of government expenditure, consumer expenditure, investments, and net exports. To increase output, we need to concentrate on these four areas and in our case particularly the consumer expenditure part. Reducing income tax for salaried employees or capping GST rates to 18 percent will have a direct impact on the cash in the hands of consumers. Public investment in education, agriculture, environmental conservation, infrastructure, etc has the potential to boost growth. Invigorating the 100 new smart cities project announced by the government can spur job creation in the construction sector for millions of workers. Creating global economic zones for foreign companies exiting China and elsewhere can be another solution.

In the words of Adam Smith “If society were to annually employ all the labor which it can annually purchase, the produce of every succeeding year would be of vastly greater value than that of the foregoing”.

References

- http://www.financialexpress.com

- taxfoundation.org

- http://www.econlib.org

- thewire.in

- http://www.bloombergquit.com

- economictimes.indiatimes.com

- indianexpress.com