India is not likely to experience a recession because it is ‘Not So Coupled’ with the Global Economy. The Minister of Finance emphasized this in parliament, saying that despite the global recession, India will still be the major country with the strongest growth. India will be doing a lot better than the rest of the world.

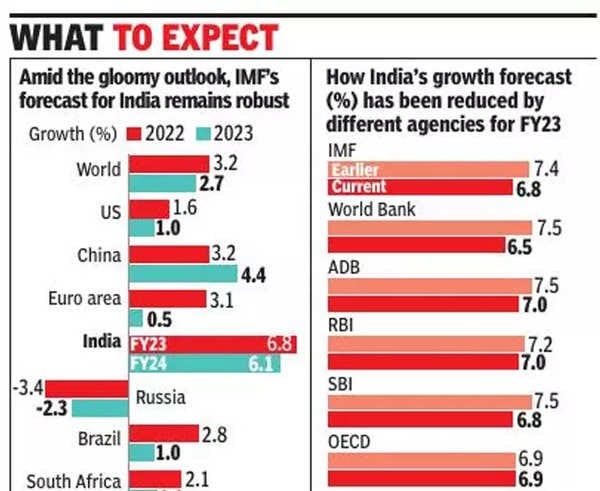

In its most recent July update on the world’s economic outlook (WEO), the International Monetary Fund (IMF) reduced India’s growth prediction for 2022–23 to 6.8%, which is slightly lower than the 7.2% forecast by the typically cautious Reserve Bank of India (RBI).

The job of an economist is challenging and becomes even more pertinent in a world that is changing so quickly. External and internal forces are present in all major economies worldwide. The majority of Indian economists predict a “partial recession” and uneven recovery going forward, saying that the central government is taking numerous steps to stabilize the economy.

The Covid-19 pandemic hit the global economy hard. And even as the economy struggled hard to recover from this, the Russia-Ukraine war arrived as another great setback. These two factors combined are expected to push the global economy into recession next year. And India is not immune.

Possible Causes:

Recession can come from fundamental and structural changes in the economy, such as failed or outdated businesses, industries, or technology that are then replaced or swept away. If the government doesn’t address that effectively, this might not be sustainable.

•Rising interest rates to arrest inflation: High-interest rates contribute to recessions by limiting liquidity, or the quantity of money that can be invested. Since May, RBI increased its repo rate by 190 basis points to 5.90 percent, which caused banks to increase interest rates on loans and deposits. Though the further hike in the interest rate may not be steep since inflation may have peaked.

•Indian exports dropped to a 20-month low between April and October, and the merchandise trade deficit doubled from a year earlier, expanding the country’s trade imbalance and rekindling fears about the country’s growing current account deficit (CAD). A current account deficit for India that ranges from 2.5 to 3 percent of its GDP is considered to be sustainable. Beyond this point, deficits are grounds for concern. A current account deficit of between 3.3 percent and 3.9 percent of GDP is anticipated for this fiscal year.

•India has seen the impact of that in the financial markets across the world, bond deals have gone up, the dollar has strengthened, and equity markets have corrected but it also started to see the impact of that on the real economy.

•India is witnessing household mortgage costs rising, household construction affordability falling and consumer’s real purchasing power falling.

•Another element that can lead to a recession is a drop in consumer confidence. Consumers are less likely to spend money if they perceive the economy as terrible. Consumer confidence is purely psychological, but it substantially affects any economy.

•Another aspect is reduced real wages, which refers to wages that have been adjusted for inflation. When real earnings fall, a worker’s pay does not keep pace with inflation. Although the worker earns the same amount of money, his purchasing power has decreased.

Solution:

Governments should help the vast majority of unemployed workers develop new skills and collaborate with businesses to increase productivity in key industries. Construction, health, textiles, logistics, education, retail, and all other low-skilled occupations where productivity is poor should be listed as areas of need and potential employment creation. We need to think about how we can retrain and upskill our employees using technology and training.

Although agriculture only makes up 17% of the GDP, it provides for the majority of the population. The government’s efforts to boost agricultural productivity should be commended and expanded upon. Cropping patterns should be examined, and produce prices should be consistent.

Tariffs for power and water should be implemented. The need for opportunities in rural areas should be addressed since increased productivity will free up labour from the agricultural sector.

Contract farming and the food processing sector should be promoted.

Way Forward:

Despite the headwinds, India will be doing a lot better than the rest of the world. Slower growth in the advanced economies may help reduce crude oil and other commodity prices, in turn helping reduce the fiscal burden on India. In actuality, India was never fully integrated into the world economy and as a result, it has minimal reliance on international markets. If the US and Europe experience a recession, a lot will rely on how international money flows behave. As the difference between the US core inflation target and the actual number is three times higher at 6%, their inflation numbers continue to evade the monetary policies taken by their central banks.